First Open Call under RDI Fund: What Makes the RDI Fund Different from Previous Schemes?

- Kaushal

- 9 hours ago

- 4 min read

India has entered a new phase of innovation financing with the launch of the Research, Development and Innovation (RDI) Fund, a ₹1 lakh crore initiative aimed at transforming how indigenous technologies are developed, scaled and commercialised. Unlike earlier government schemes that relied largely on grants and subsidies, the RDI Fund introduces a market-oriented, investment-driven approach to support high-risk, high-impact innovation.

The first Open Call under the RDI Fund was launched by Union Minister of State (Independent Charge) for Science and Technology Dr. Jitendra Singh, signalling a decisive policy shift in India’s science, technology and innovation ecosystem.

What Is the RDI Fund?

The Research, Development and Innovation (RDI) Fund is a Special Purpose Fund created under the RDI Scheme, a flagship initiative of the Department of Science and Technology (DST). The fund is anchored under the Anusandhan National Research Foundation (ANRF) and implemented through professional financial intermediaries.

Core Objective of the RDI Fund

The core objective of the RDI Fund is to accelerate investment in India’s RDI ecosystem by supporting:

Private sector enterprises

Startups and MSMEs

Industry-led innovation projects

The fund aims to help transform research ideas into globally competitive technologies and products, particularly in sunrise and strategic sectors.

What Makes the RDI Fund Different from Previous Schemes?

The RDI Fund represents a fundamental departure from conventional government funding models.

Key Differences Explained

Earlier Schemes | RDI Fund |

Grant-based support | Investment-based financing |

Focus on early research | Focus on commercialisation |

Limited private-sector role | Strong private-sector participation |

Short-term funding | Long-term patient capital |

Minimal risk-sharing | Equity and hybrid risk-sharing models |

According to Dr. Jitendra Singh, governments have traditionally encouraged innovation through philanthropy, CSR or grants, while direct government-backed financial support for private innovation remained limited. The RDI Fund bridges this gap by enabling private enterprises to scale technologies in sectors that were earlier confined largely to the public domain.

Ministry of Science and Technology Launches First RDI Fund Open Call

The Ministry of Science and Technology has launched the first Open Call under the RDI Fund, implemented through the Technology Development Board (TDB). This is the first TDB call under the RDI framework and focuses on projects at Technology Readiness Level (TRL) 4 and above.

The initiative is designed to strengthen India’s innovation ecosystem by supporting the commercialisation of indigenous technologies through structured, long-term financing.

What Is Technology Readiness Level (TRL) and Why TRL 4 Matters?

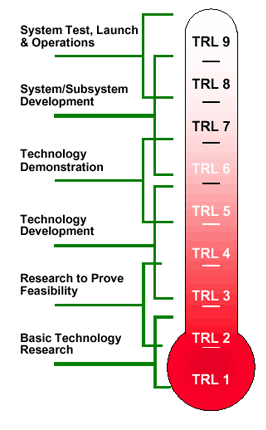

Technology Readiness Level (TRL) is a globally recognised system used to assess the maturity of a technology.

TRL was originally introduced by NASA

It uses a nine-level scale (TRL 1–9) to track progress from ideation to commercial deployment

TRL Scale Explained Simply

TRL 1–3: Basic research and proof of concept

TRL 4: Technology validated in a laboratory

TRL 5–6: Prototype tested in relevant environments

TRL 7–9: Market-ready and commercial application

The first TDB Open Call under the RDI Fund supports projects at TRL 4 and above, ensuring that funding is directed toward technologies with demonstrated feasibility and realistic market potential.

RDI Fund Corpus and Funding Structure and and Financial Terms

Total Corpus

₹1 lakh crore over six years

Modes of Funding

The RDI Fund does not provide grants. Instead, it uses a structured financing framework:

Long-term collateral-free loans:Up to 50% of the total project cost

Equity participation:Up to 25% of the assistance sought

Debt-to-equity conversion:Option available at a later stage

Financial Terms

Interest rate: Concessional, around 2–4%

Tenure: Up to 15 years

Moratorium: Available

Collateral: No personal or corporate guarantees required

This structure is designed to reduce financial risk for innovators while maintaining accountability and financial discipline.

Priority Sectors Under the RDI Fund

The RDI Fund prioritises projects aligned with India’s long-term economic and strategic needs, including:

Energy security, energy transition and climate change

Deep technologies (Quantum, Robotics and Space)

Artificial Intelligence for Indian applications

Biotechnology and medical technologies

Digital economy and digital agriculture

These sectors are critical for India’s technological sovereignty and global competitiveness.

Role of the Technology Development Board (TDB)

The Technology Development Board (TDB) is the first Second Level Fund Manager (SLFM) to operationalise the RDI Fund. Under the first Open Call:

Funding support is provided through loans, equity or hybrid instruments

Maximum support is up to 50% of total project cost

Matching contributions are required from companies or private investors

Evaluation follows defined timelines for faster disbursement

Evaluation and Selection Criteria

Project proposals are evaluated based on:

Scientific merit

Technological robustness

Financial viability

Commercial potential

The RDI Fund is strictly focused on sustainable commercial deployment, not one-time support.

Strong Industry Response to the First RDI Call

Dr. Jitendra Singh informed that the first TDB Open Call under the RDI Fund received nearly 191 proposals, with a significant majority from the private sector. This response reflects growing confidence among Indian enterprises in the government’s commitment to innovation-led growth.

The Minister emphasised that applications must align with the spirit of the scheme and that funds should be used strictly for genuine technology development and scale-up.

Opening Strategic Sectors to Private Innovation

The Minister noted that the opening of strategic areas such as space and nuclear sectors to private participation has changed long-standing conventions. The RDI Fund has been specifically designed to support this transition by:

Reducing financial risk

Offering long-term affordable capital

Introducing equity-linked risk sharing

This marks a structural shift in how India supports advanced and strategic technologies.

Approval and Launch Timeline

Approved by the Union Cabinet: July 2025

Launched by Prime Minister Narendra Modi: November 2025

First TDB Open Call: 2026

Why the RDI Fund Is a Structural Reform, Not Just a Scheme

The RDI Fund is not a short-term announcement or a conventional funding program. It is a structural reform in innovation financing, designed to create a sustainable pipeline from research labs to global markets.

By combining patient capital, risk-sharing and private-sector leadership, the RDI Fund addresses one of India’s longest-standing challenges in technology development.

The launch of the RDI Fund marks a turning point in India’s innovation journey. By moving away from grant dependence and embracing investment-led support, the government has laid the foundation for a globally competitive, self-reliant innovation economy.

For startups, industries and technology developers working at the frontier of innovation, the RDI Fund represents an unprecedented opportunity to scale ideas into impact.

Comments